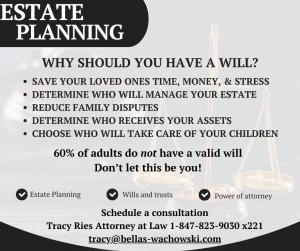

The recent deaths of Hollywood legend Gene Hackman and his wife of the past three decades, Betsy Arakawa, very close in time to one another have led to a potentially messy situation in which one of Hackman’s children might be contesting his will. The scenario highlights why it’s important that trust and estate documents account for all possible outcomes and give those you leave behind an unambiguous path to disbursing your assets.

The recent deaths of Hollywood legend Gene Hackman and his wife of the past three decades, Betsy Arakawa, very close in time to one another have led to a potentially messy situation in which one of Hackman’s children might be contesting his will. The scenario highlights why it’s important that trust and estate documents account for all possible outcomes and give those you leave behind an unambiguous path to disbursing your assets.

Official reports appear to show that Arakawa died from the rare disease hantavirus and that Hackman—suffering from Alzheimer’s disease and likely not lucid enough to have called police about his wife’s death—passed away about a week later from cardiovascular disease.

Hackman’s 2005 Living Trust names Arakawa as his sole beneficiary for his $80 million estate, but since she appears to have died first, it’s not entirely clear what happens next. His daughters Leslie and Elizabeth and son Christopher are not named anywhere in the documents.

Chicago Business Attorney Blog

Chicago Business Attorney Blog